– Most personal wealth is now in female hands

What a turnabout. Half a century ago feminism was all about celebrating women’s success. There was huge excitement about women’s progress in achieving rewards and riches in what was once a man’s world. The media was cock-a-hoop about how well we were doing, breaking through those glass ceilings to bring in the big bucks.

What happened? At some point the Powers That Be decided it was in women’s interests to play down this success. The public narrative is now all about women being badly off, struggling to survive in this dog-eat-dog world where men still come out on top.

Now all we ever hear about is downtrodden women needing assistance to cope with their unfair treatment. Homeless women. Poverty-stricken women living on meagre pensions or insufficient superannuation. Oppressed, disadvantaged, and always, always in need of more financial support.

Sure, there are many women in trouble. But the relentless moaning is actually a cover for a far bigger story. The truth that is being strenuously downplayed is that, overall, women will soon be sitting pretty, right on top in the wealth stakes.

“Women will soon have more money than men for the first time in history!” trumpeted Fortune magazine last week , explaining that women are on the verge of controlling the majority of personal wealth. “The unprecedented transfer of wealth to women is projected to reach $30 trillion in the next decade,” said author Sara Lomelin, quickly passing over this extraordinary news to gloat about an imagined boom in philanthropy with generous women in charge.

In Australia, women’s ship has also come in. A recent report by JB Were – The Growth of Women and Wealth – predicts a “tsunami” of inheritance heading in women’s direction. The wealth management company estimates women will inherit $3.2 trillion in the next decade, mainly due to longer-living wives inheriting from husbands.

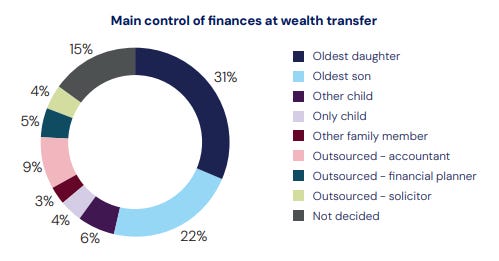

But even when the wealth is transferred to the next generation, for some reason oldest daughters will benefit the most, say these experts.

Of course, women stand to gain not just through the death of their wealthy partners, but also as a result of divorcing them. JB Were looked at the approximately 10,000 High Net Worth couples who divide their assets each year and estimated that would result in a $30 billion asset pool converting to roughly $15 billion in the hands of the women. Not bad, eh?

In May 2023, Andrew (Twiggy) Forrest was the second richest person in Australia. Or so it seemed. But any man who has been through the family law system will tell you that a man’s grip on his assets is tenuous at best. After Twiggy and his wife split and the family law system had done its thing, he tumbled down the Rich List, dropping to Number 10 and he was overtaken by a new entrant – his wife, who entered at Number 8.

Nicola Forrest entered the Rich List for the first time ranked eighth overall, becoming Australia’s third-richest woman, with a $14.6 billion fortune. Nice work if you can get it…..

The key point is that much of the wealth nominally owned by men in fact belongs to their wives – as soon as these women decide to get rid of them.

So, it is easy to see why it is that our feminists aren’t shouting from the rooftops about this massive new achievement of wealth for women. The fact is that most of the money that is pushing women into the top wealth category comes not from their own efforts but from the men in their lives.

Naturally, they don’t even need to divorce them or wait for them to drop off the twig. The reality is, as economists will tell you, savings are simply deferred consumption. The objective of acquiring wealth is spending and here women really excel.

The hands firmly in control of spending are usually female. Some facts on spending:

– 64% of travellers worldwide are female-

– 80% of all travel decisions are made by women

– 85% of solo travellers are women

– 230% increase in travel companies dedicated to female clientele

- Vehicles – Women buy more than 60% of all new cars

- Property – slightly more women than men own property.

The property issue is interesting because younger women are less likely to own property than men but in middle age female ownership takes over. CoreLogic Head of Research Eliza Owen speculates, “This suggests women may be empowered to buy property later in life.” Yes, well, it just so happens that this empowerment happens around ages 25-45 when divorce is most common. Reminds me of the joke about “How many divorced men does it take to change a light bulb?” No one knows, because they are homeless.

The reality is all that moaning about women’s sack cloth and ashes is a smokescreen for the true picture of women’s good fortune. Not only are many women ending up with all the loot when they find themselves on their own, but they are usually the ones in charge of spending the couples’ money when they are together. Not exactly a hard luck story.

All of this makes a mockery of our media’s relentless whining about women’s miserable superannuation. The ABC served up a classic just recently with the story of Debra Moxon and her dog, Georgie. Here she is..

The article follows the normal ABC format of focussing on the “lived experience” of some vacuous female friend of the reporter rather than, say, facts. Nothing new – except that, with this article, the ABC has moved beyond parody. Here’s a summary:

I’ve got this friend Deborah. Do you know Deborah? She’s lovely. You’d really like her. Well, you’ll never believe what she told me. She left her job so she could go on a never-ending holiday and now she thinks she may not have enough income! And she took out her super to buy a camper van and now, like, she thinks she might not have enough super! And I just think that’s so unfair. I mean, she should be given lots of money – that’s just gender equality, right?

The middle of the article cuts to pronouncements from a feminist “expert” – in this case a male from the Australia Institute. Despite the ABC pushing their “women are victims” line, the Australia Institute report provides almost no support for their claim of a “retirement savings gap of 23.4%.”

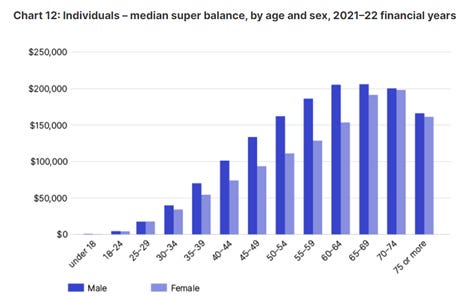

To understand the real numbers, consider the ATO’s latest data on super balances released 14 June. The chart does indeed show a significant gap at the point of retirement, but that’s misleading. Much more important is how much you have when you are actually retired and need the money. As the ATO data shows, from age 65 on, when it matters, the “gap” all but disappears.

Here’s what I wrote four years ago, commenting in another boondoggle from Australia Institute claiming Australia’s tax concession system is stacked against women:

As women grow older the gender gap in super miraculously evens out, with men and women ending up pretty much level. This means that one way or another, older women end up with more of the men’s loot.

It’s highly unlikely that these older women are suddenly earning much more to account for their increase in super balances. Most of them must be losing their partners and ending up on their own. Many of these women outlive their men – the current gap in life expectancy is about five years and with most women partnering slightly older men, they enjoy the financial benefits for long after his passing. As named beneficiaries for the man’s super what was his is now hers.

It’s all been happening for many decades and our media, our professional commentators are assiduously choosing not to notice. And now they are busily ignoring this amazing news about the fortunes of women because it challenges the party line.

Perhaps one day soon we will be treated to an ABC update on Deborah. I like to picture her blasting down the highway in her super-fuelled campervan singing along with Dire Straits – “Money for Nothing.”